Wyoming Credit Union: Trusted Financial Solutions for Every Requirement

Wyoming Credit Union: Trusted Financial Solutions for Every Requirement

Blog Article

Elevate Your Financial Experience With Cooperative Credit Union

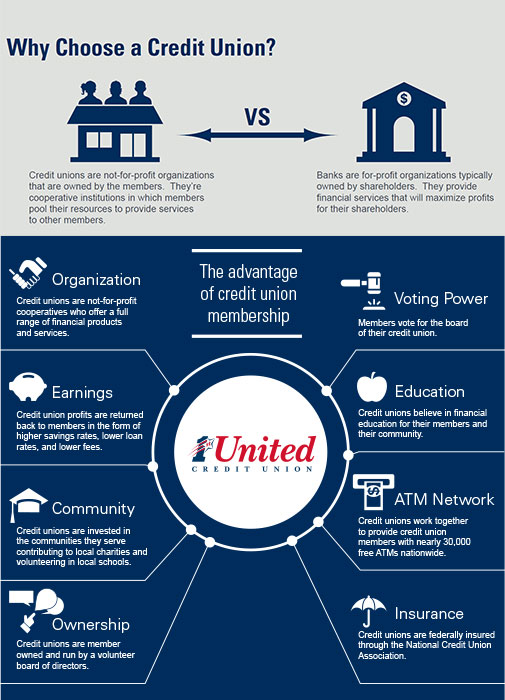

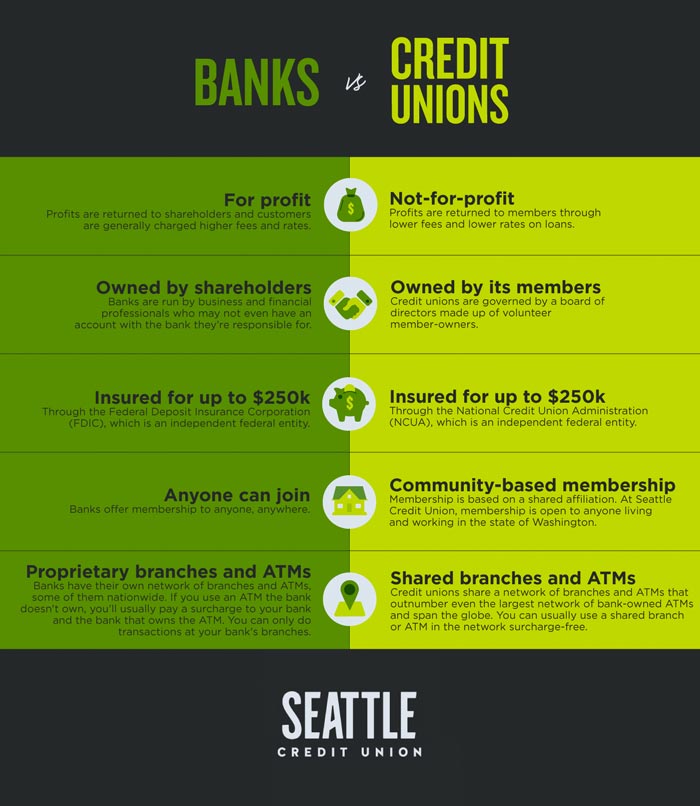

Discovering the realm of financial experiences can often bring about uncovering surprise treasures that provide a rejuvenating departure from typical banks. Debt unions, with their emphasis on member-centric services and community involvement, present a compelling alternative to traditional financial. By prioritizing private needs and cultivating a feeling of belonging within their subscription base, cooperative credit union have taken a particular niche that resonates with those seeking a much more tailored method to handling their financial resources. But what sets them apart in terms of raising the banking experience? Allow's delve deeper into the special advantages that lending institution give the table.

Advantages of Cooperative Credit Union

An additional benefit of lending institution is their democratic framework, where each member has an equivalent enact choosing the board of supervisors. This ensures that decisions are made with the most effective passions of the participants in mind, as opposed to concentrating only on making best use of revenues. In addition, lending institution often use financial education and counseling to help members improve their financial literacy and make informed decisions about their cash. On the whole, the member-focused strategy of credit scores unions sets them apart as establishments that prioritize the health of their neighborhood.

Subscription Requirements

Debt unions generally have particular standards that people need to meet in order to enter and access their financial services. Subscription needs for lending institution frequently include eligibility based on factors such as an individual's place, company, business affiliations, or various other qualifying connections. For example, some lending institution might serve individuals who work or live in a certain geographical location, while others might be affiliated with particular companies, unions, or organizations. Additionally, household participants of existing lending institution participants are usually qualified to sign up with as well.

To become a participant of a cooperative credit union, people are generally needed to open an account and preserve a minimal deposit as defined by the organization. In some instances, there might be single membership charges or recurring membership fees. Once the membership requirements are fulfilled, people can delight in the advantages of belonging to a cooperative credit union, including access to customized monetary services, affordable interest rates, and a concentrate on member fulfillment.

Personalized Financial Solutions

Customized financial services tailored to individual requirements and choices are a characteristic of cooperative credit union' dedication to participant fulfillment. Unlike traditional financial institutions that frequently provide one-size-fits-all services, credit rating unions take a much more personalized technique to managing their participants' financial resources. By recognizing the unique objectives and situations of each participant, lending institution can provide tailored referrals on cost savings, financial investments, car loans, and various other monetary products.

Additionally, lending institution typically supply lower charges and competitive rate of interest rates on savings and finances accounts, even more improving the customized financial services they provide. By concentrating on private demands and providing customized remedies, cooperative credit union establish themselves apart as trusted monetary companions committed to helping members prosper monetarily.

Neighborhood Involvement and Support

Neighborhood involvement is a keystone of lending institution' objective, reflecting their commitment from this source to supporting local initiatives and cultivating significant connections. Credit scores unions actively take part in community events, enroller local charities, and arrange financial literacy programs to inform non-members and participants alike. By purchasing the areas they offer, credit scores unions not just reinforce their partnerships however also add to the overall wellness of culture.

Supporting small companies is another method lending institution demonstrate their dedication to regional areas. With providing bank loan and monetary guidance, credit rating unions help business owners thrive and promote financial development in the area. This assistance exceeds just financial help; cooperative credit union typically supply mentorship and networking chances to assist local business succeed.

In addition, lending institution often engage in volunteer job, urging their workers and participants to return through numerous neighborhood service tasks - Federal Credit Union. Whether it's taking part in local clean-up occasions or organizing food drives, cooperative credit union play an energetic duty in boosting the lifestyle for those in requirement. By prioritizing neighborhood involvement and support, lending institution really symbolize the spirit of participation and common support

Electronic Banking and Mobile Apps

In today's electronic age, contemporary financial benefits have been reinvented by the widespread fostering of mobile applications and on the internet systems. Lending institution are read the full info here at the leading edge of this electronic makeover, supplying members safe and hassle-free ways to handle their financial resources anytime, anywhere. Electronic banking services offered by lending institution enable participants to inspect account balances, transfer funds, pay expenses, and see transaction history with simply a couple of clicks. These systems are developed with easy to use interfaces, making it easy for members to navigate and gain access to crucial banking functions.

Mobile apps provided by credit rating unions even more enhance the banking experience by giving additional versatility and availability. Generally, debt unions' on-line banking and mobile apps encourage participants to handle their finances efficiently and firmly in today's fast-paced digital globe.

Verdict

In final thought, credit scores unions offer an one-of-a-kind banking experience that prioritizes neighborhood involvement, personalized service, and member satisfaction. With lower costs, affordable rates of interest, and tailored economic services, cooperative credit union accommodate private needs and promote economic well-being. Their democratic framework worths participant input and supports local communities via different efforts. By signing up with a credit report union, people can elevate their banking experience and construct solid partnerships while appreciating the benefits of a not-for-profit banks.

Unlike banks, credit history unions are not-for-profit companies possessed by their participants, which usually leads to reduce charges and much better interest prices on cost savings accounts, fundings, and debt cards. Furthermore, debt unions are recognized for their personalized customer solution, with team participants taking the time to recognize the special financial goals and obstacles of each participant.

Credit unions frequently supply economic education and therapy to help members enhance their financial literacy and make informed choices about their money. Some credit unions may offer individuals who work or live in a specific geographic area, while others might be affiliated with certain companies, unions, or organizations. Additionally, family members of existing credit union members are frequently qualified to sign up with as well.

Report this page